By Dan Roberts

When setting regional goals you need hard data to back up your position. Otherwise, you might be setting unsuitable goals. Market data allows you to quantify the opportunity. When you know the opportunity, you can plan revenue targets, resources, and investments at the right level to help the team deliver.

Imagine a scenario where a global architecture, engineering, and construction (AEC) software vendor, called Imaginary Software, is trying to set regional sales targets. This involves the development of a set of charts to support a meeting between the CMO and the three regional heads of America (AMER), Asia Pacific (APAC), and Europe, Middle East, and Africa (EMEA).

The approach is to look at the regional market size and growth from several different points of view, including the competition, industry, and employment. What is the performance of Imaginary Software’s competitors? What will their growth be? What growth is forecast in the vertical market sectors served by Imaginary Software? How many potential users of Imaginary Software’s products are based in each of the regions?

Competitor View

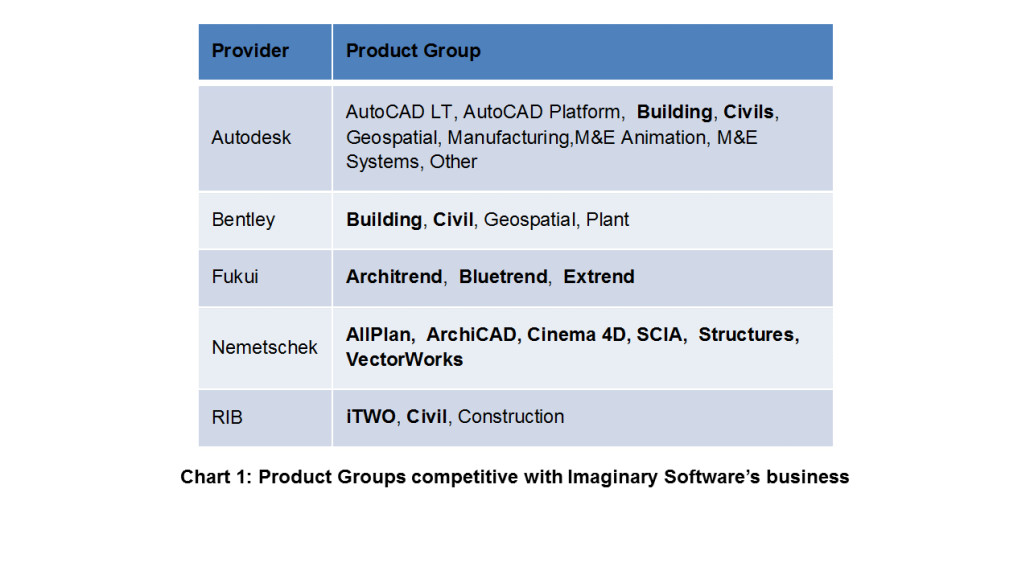

In our example, five providers are the source of competition for Imaginary Software. The available product group analysis for these five providers is shown in Figure 1. The 15 product groups that compete with Imaginary Software are shown in bold.

Selection of the data for these product groups provides a quantitative framework for this market, with both historic and forecast revenues for each product group in each of the three regions. For this scenario, the aggregated growth numbers are critical, but the revenue figures for new licenses, maintenance and subscription, and professional services help trigger insights as well as market understanding.

Competitor Growth

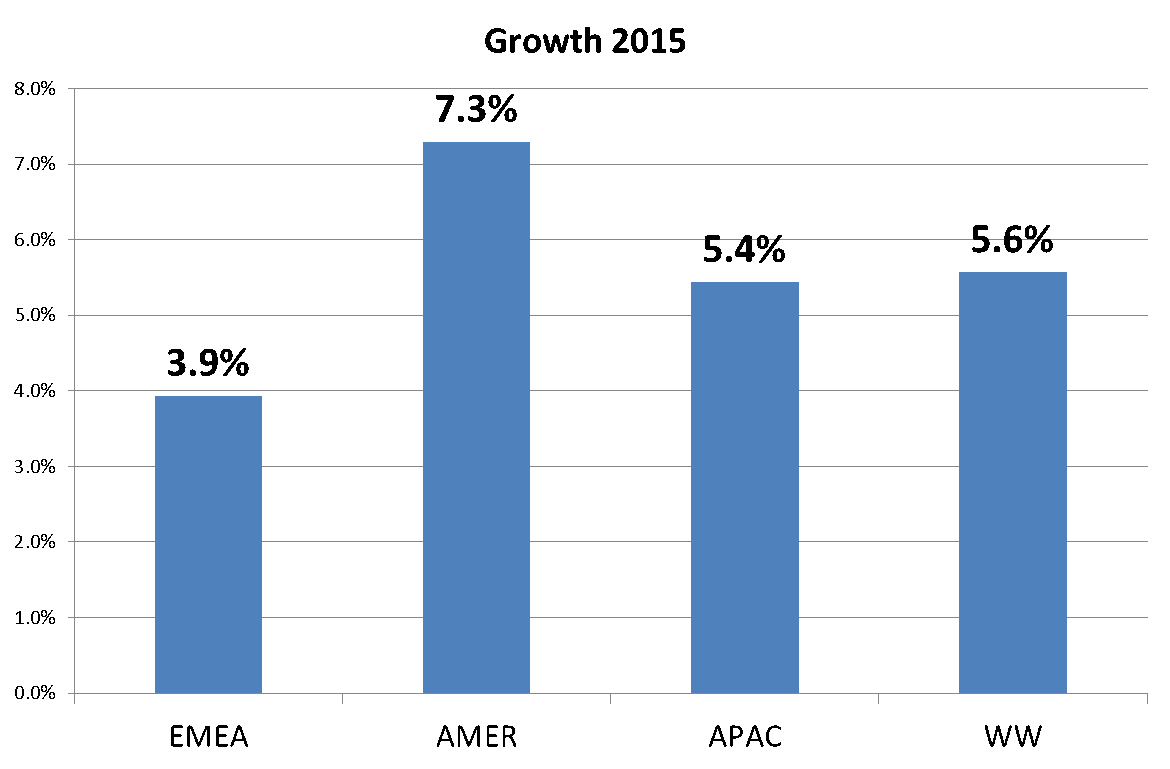

One of the most important factors in goal setting is how much the market is growing or declining. The 2015 forecast of regional growths for the selected set of competitive products are shown in Figure 2.

Imaginary Software’s marketing objective is increasing market share. This means it’s growing faster than the competition, so the EMEA team will need to beat the 3.9 percent growth of the competing products, APAC needs to better 5.4 percent, but AMER needs to top 7.3 percent growth. If you gave each region the target of growth higher than the global figure of 5.6 percent, then you’d be offering the Americas team a walk in the park, whereas the EMEA team would be facing a serious challenge. What would most likely happen is that you would lose market share in AMER, whilst failing to meet your target in EMEA—as the goal was unattainable, leading to a loss of market share overall.

Industry View

Remember the scenario. We are preparing data to help the CMO discuss next year’s targets for the regional heads. We have selected 13 verticals to define Imaginary Software’s AEC sector. The revenue figures for ‘technical application software EUE’ include CAD/CAM/CAE/PLM/GIS/BIM etc. This is a broader scope than the 11 product lines we looked at with the competitors. This is helpful if there are differences in the growth pattern for this broader market. Then Imaginary Software’s offer, along with that of its competitors, is either growing or falling in importance compared to the other technical applications software used in AEC verticals.

Even before looking at the growth, the availability of data that divides Imaginary Software’s AEC sector into 13 sub-sectors drives insights into market opportunity. When you look at technical application spend across the 13 sectors, the majority is in the service and consultancy segments, such as architecture firms or civil engineering consultants.

Industry Growth

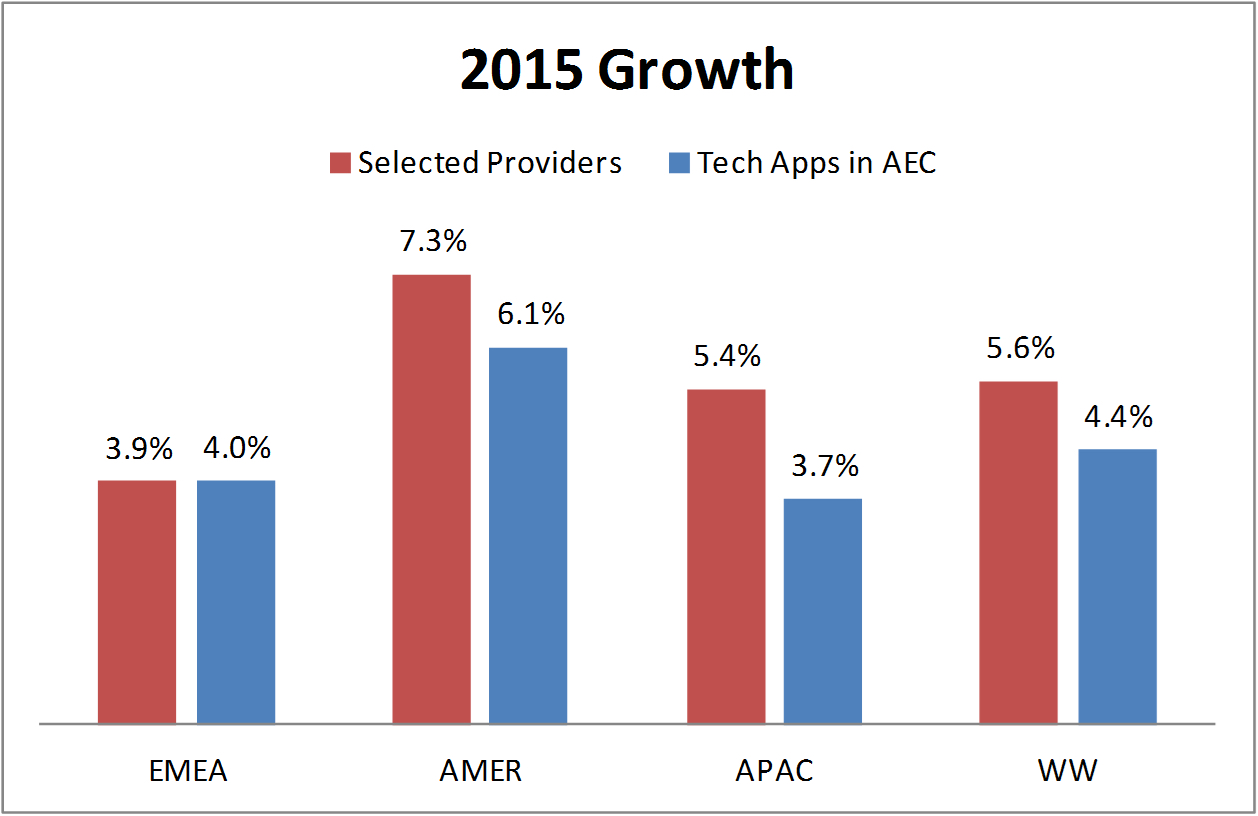

For the purposes of goal setting, we need to look at the forecast growth of this AEC market in relation to the group of competitors we used earlier, which is outlined in Figure 3.

This shows some interesting trends. The selected providers are growing faster in 2015 than the AEC sector as a whole—5.6 percent versus 4.4 percent. This difference isn’t uniform around the world—in EMEA, the difference is negligible. In the Americas it’s 1.2 percent and in APAC it’s 1.7 percent.

This helps put the 2015 growth figures in context for meetings with regional heads.

This chart may also prompt an interesting discussion on what is going on in the EMEA.

Employment View

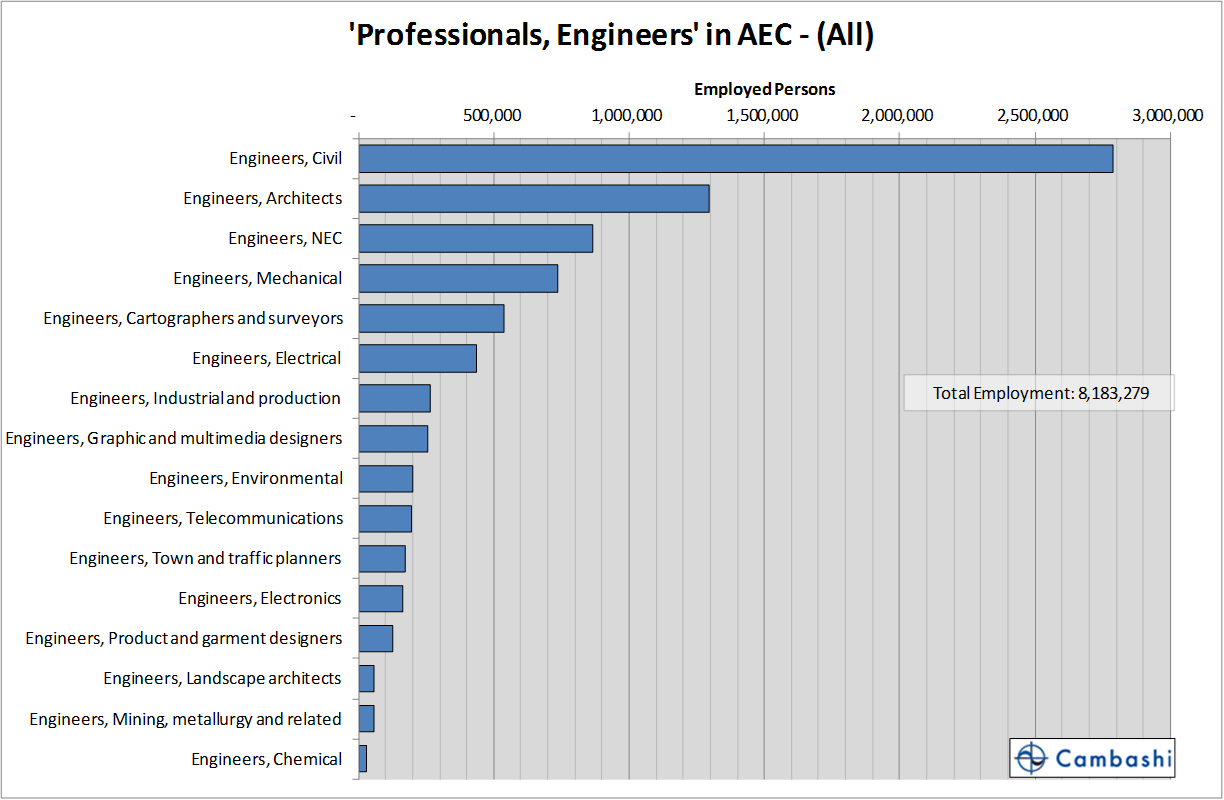

The third market view is looking at the employment distribution. We can pick the same set of 13 industry sectors as for the Industry Observatory to look at the same AEC market. There are 208 million people employed across the world in these sectors. The majority of these people are in trade or non-technical occupations. Imaginary Software is focused on the eight million professional engineers in this group of 208 million employed.

These eight million are distributed amongst 16 different detailed engineering occupations, see Figure 4.

This range of ‘types’ of professional engineer may trigger questions that the CMO wants to think about.

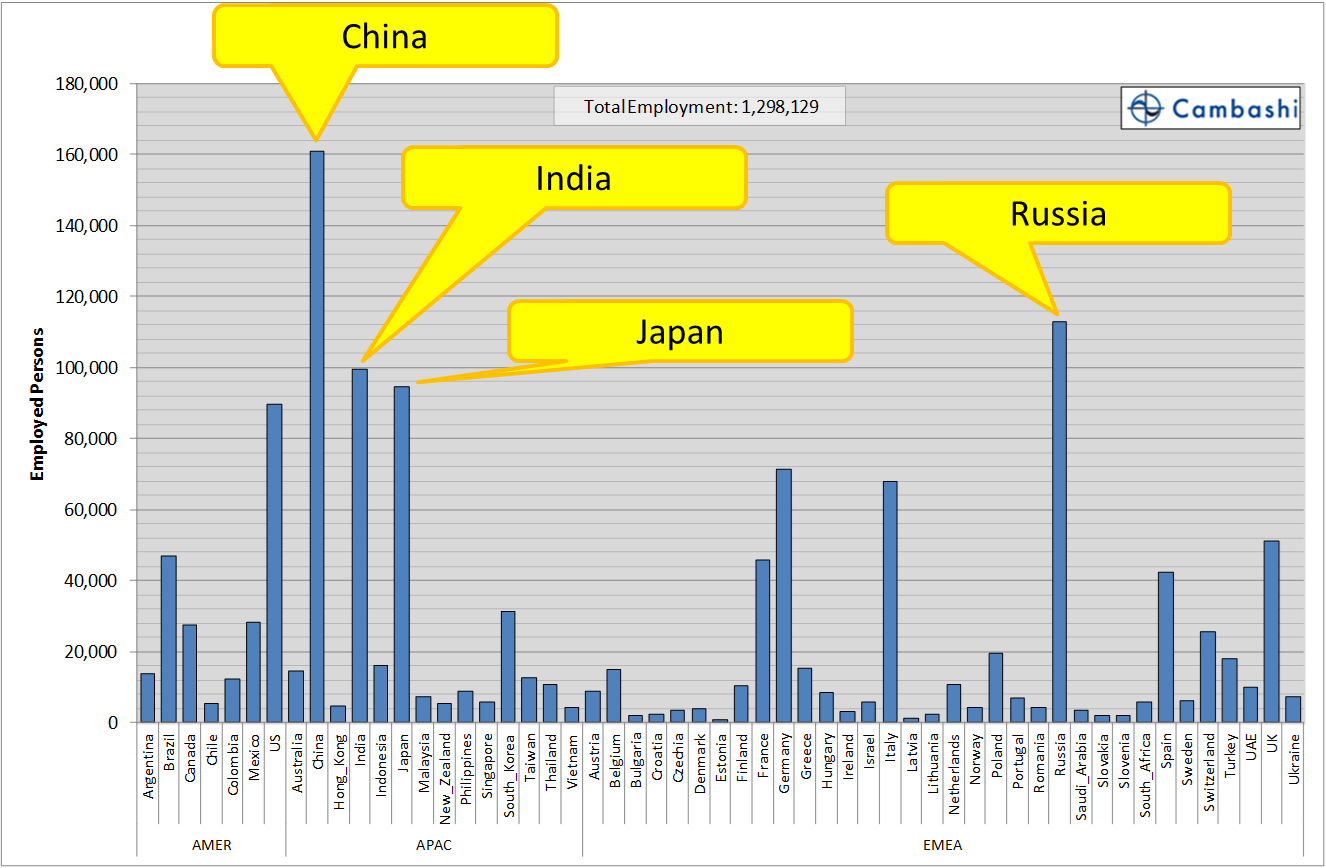

Imaginary Software believes that often, the person in an account who tends to be the key influencer has an ‘Architect’ job title. So the distribution of the approximately 1.3 million people classified as ‘Engineers, Architects’—the second bar down in Figure 4—could be interesting. This breakdown is shown in Figure 5.

Head count is no substitute for revenue numbers. But for those seeking some view of the total available market and how much opportunity there is for their software, employment figures provide a handle.

Conclusion

Market datasets provide a quantitative framework for business decision making. In this scenario, we’ve looked at revenue growths. The regional heads know that Imaginary Software wants to gain market share. I think the CMO will be able to convince them that beating the market means different growth targets in each region.

Comparing figures based on different perspectives improves confidence in the figures.

In this scenario, I expect everyone will agree to split the difference between the growth of the benchmark competitor product groups, and the growth of technical applications in the AEC sector to get a baseline regional growth target. I also expect the relative sizes of the sub sectors that make up the AEC sector will trigger some discussion. Even after currency adjustments, it looks like the Americas will get the largest percentage growth target, and that will trigger discussion on head counts and budgets as well as the content of sales and marketing initiatives. The employment view then gives the CMO insight into what types of messages will work for the target users.

Overall, this illustration shows how data sets and knowledgeable marketing intelligence support successful goal setting. SW

Dan Roberts is senior consultant for the research analyst and consulting group, Cambashi, and is the organization’s industry segmentation expert. He has developed several of Cambashi’s robust data analysis reports called the Observatories. Roberts provides IT vendors with insights to improve their strategic marketing decisions.